Would you say that money makes you happy? The appropriate response is NO.

However, would you say that a little more money would make you a little happier? It’s fair to say YES.

Funny enough, our happiness is not connected to our bank accounts. Not at a global level at least. Most of the ‘wealthy’ countries in the world are at the lower end of the ‘happiness’ scale. (USA is an example) Where as some of the countries that are at the bottom end of wealth and prosperity are in the top ten of those who are happy. (Guatemala is an example of this). C.S. Lewis said,

“Don’t let your happiness depend on something that you can lose”Money is a funny thing. We need it to live, to travel, to eat, to get educated – many of the good things in life. However, we’ve seen money cause some nasty things in peoples lives, especially when it’s given too much value or prominence.

In Matthew 6 Jesus says, “You cannot serve both God and money.” Jesus is onto something here. Why? Because as good a tool as money is, it makes a really horrible god. Money wasn’t meant to be longed for or worshiped or coveted, it’s simply meant to be a resource to fund and fuel the lives that we are called to and choose to live.

“Money is a wonderful tool, but it makes a horrible god.”

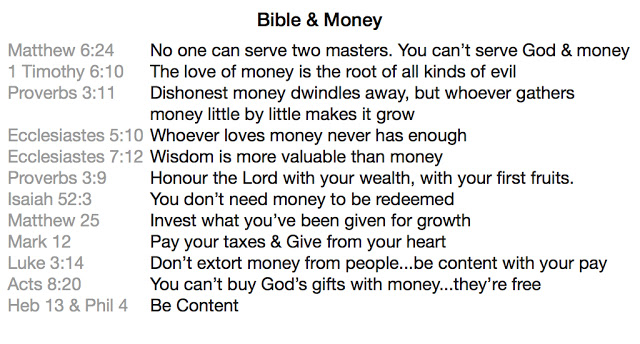

Matthew 6 isn’t the only place the Bible talks about money. There are more than 1000 references to money, currency or related issues. If you’re wondering why, it’s because the bible is a book about people and community and relationships, and wouldn’t you know it, money is always in the middle of those things. The other reason is that money is tied to our values. If you’re not sure what’s important to you, check out your bank statement or credit card bill, those two things are a pretty accurate reflection of what’s important to us.

In the future we’ll spend a few weeks (posts) on a more thorough look at how our faith changes our perspective on money and resources. For this post, let’s just look at 5 beliefs that will lead to financial reconciliation or peace.

1. All we have comes from God.

This is the best place to start. Things often begin getting out of sorts with money when we forget who our provider is. I’ve said before that no matter what name is on your paycheck, hidden underneath there somewhere it says, ‘God gave this to me’.

Starting here adds two very important ingredients to our lives, humility and perspective. We can never get too arrogant about how much we have if we know that God is the provider. Wisdom says, “I didn’t get here on my own”. Faith says, “God had something to do with it.” Starting here will change the rest of the conversation on money.

2. I live joyfully within God’s current provision for my life.

In other words, Be Content (Heb 13, Phil 4).

It’s our human nature to wish for more. It’s our human nature to want what we don’t have. Think about how many times you’ve asked yourself what you would do if you won the lottery? I don’t even play the lottery and I ask myself that question. The Bare Naked Ladies asked this question in their classic song, “If I had a million dollars”.

Here is where we can get in trouble with debt. Bill Hybels says, “Debt comes from wanting more than God’s current level of provision for you life and arranging other ways to get it.”

Simplifying our lives includes living within our means; being content with what God has provided in each season of life we are living.

3. I want to honour God by giving my first fruits for his purposes in the world.

This might be the toughest thing to talk about when we discuss finances. Tithing, giving away 10% of your income, is an interesting shift for someone that’s not used to it. However, it can be the most freeing way to live if we fully trust God.

When you start with the first belief (above), this third one kind of comes naturally. The two main places in scripture we see this is

Malachi 3:10 and

Proverbs 3:9. The problem with these verses is that we view them as (OT) law, when really they are simply a biblical principal to practice. When we view this as law we’re making it religious and discounting the New Testament and Jesus. Jesus came to fulfill the law, to move us away from the law and lead us to a new way of love. What do you think inspires more generosity, law or love?

The reasons you’d consider instilling this principal into your budget are…

– You trust God with your finances and believe that everything you have comes from him

– You love the local church and believe it’s the hope of the world

– You identify that giving towards causes that are outside of yourself is actually a healthy way to live

– You fully believe that giving a portion of your income is the best way for you to make things less about you. The more we give the more self-less we become.

This belief takes the most faith, but also reaps the most rewards. And the coolest part is, once you start giving that much away, your desire to give more actually increases.

4. I will set aside a portion of my income (10%) for savings, emergencies, later years, etc.

If giving reinforces that it’s not all about ‘us’, then saving, in the same way, reminds us that it’s not all about ‘now’.

Winter is coming. It always arrives. Sooner or later, something breaks down, somebody gets sick, a car stops working, a career doesn’t go as planned. You get the idea. If we only live in the present and don’t plan for the future, we will enter the difficult seasons of life unprepared.

Here’s the equation that has proven to work best for many wise people:

10 – 10 – 80

10% towards giving

10% towards saving

80% towards living

If your income grows you can always up the first two percentages. On the other hand, the last percentage should never increase, only decrease. Make sense?

5. Live each day, open to hear God’s whisper in your life about opportunities to bless others and make a difference.

Everything we’ve talked about up to this point can lead to the most amazing way to experience God in our lives. If we give, save, and then live on the rest, God can and will do wonderful things in and through us. Being responsible with our income will give us opportunity to bless others. Living simply will enable us to bless extravagantly. Who doesn’t want to experience that kind of joy and freedom with our finances?

Hope this was helpful. Feel free to engage the comment section of this blog if you have any questions.

Money, like time, is in scarce supply, once you spend it it’s gone, so use it well.

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

small(er) group discussion:

Why is it difficult to talk about money? Especially in or within the church?

How have we convinced ourselves that money actually makes us happy?

Out of all the verses listed above, which one speaks to you or challenges you the most?

– How can money become a god in someone’s life?

Be honest with this one, what’s the toughest thing about tithing? Disregarding how some “christians” (especially those on TV) have ruined our view of giving, why is tithing a good principal?

– Share why it’s difficult or why it’s a beautiful thing. No judgement!

Is ‘saving’ as God-honouring as ‘giving’? If so, why?

Have you have ever been on the giving or receiving end of Belief #5? Perhaps you were blessed by someone listening to God…or…you listened to God and blessed someone?

Close tonight be praying for open hands, large hearts, wise minds and clean balance sheets. And anything else you’d like to pray for!!!

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

Bonus Coverage

A few tips on saving…

– If you have a work retirement, great, but don’t count (only) on that and government CPP for future years

– Don’t throw extra money in an RRSP if you don’t have to. Use up TSFA limits so that when the time comes to use this money, the government won’t tax you on it. RRSP’s are great if they help lower your taxes, but if you’re in a lower bracket, you might not really need those savings now and will be thankful later that you saved them in a non-registered account.

– Use any method you can to save: monthly contributions, change jars, bank the rest programs, etc.

– Use reward cards to your benefit: Starbucks, Canadian Tire, PC points, etc. Don’t spend more to get points, but if you are going to use these stores at least let them work in your favour a little.

– If you make some extra money with overtime or a surprise side job, don’t just blow the money, decide how to best use it (e.g. put 1/2 of it on your mortgage or car loan or in a savings account)

– of course, budget for everything

– tell your money where to go, don’t let it boss you around

* please note that we borrowed the above 5 beliefs titles from Bill Hybels.

Funny enough, our happiness is not connected to our bank accounts. Not at a global level at least. Most of the ‘wealthy’ countries in the world are at the lower end of the ‘happiness’ scale. (USA is an example) Where as some of the countries that are at the bottom end of wealth and prosperity are in the top ten of those who are happy. (Guatemala is an example of this). C.S. Lewis said, “Don’t let your happiness depend on something that you can lose”

Funny enough, our happiness is not connected to our bank accounts. Not at a global level at least. Most of the ‘wealthy’ countries in the world are at the lower end of the ‘happiness’ scale. (USA is an example) Where as some of the countries that are at the bottom end of wealth and prosperity are in the top ten of those who are happy. (Guatemala is an example of this). C.S. Lewis said, “Don’t let your happiness depend on something that you can lose”