When you have nothing to talk about, you talk about? THE WEATHER.

When you have something to talk about, we still talk about? THE WEATHER.

The weather is the easiest thing to talk about? Why?

- Because we have no control over it

- We can’t get blamed for it

- We can’t escape it

- And…it’s easy

What’s not so easy to talk about? MONEY!

You may have heard this before – that some married couples will never talk about Religion, Politics, and…MONEY. They vow that it helps their marriage! Those three things have caused many arguments, but the weather, that’s a safe topic.

Out of the three, money is by far the most divisive. It has broken up many relationships.

If I were to ask, does money make you happy? you’d probably say, no.

But…

If I were to also ask, would a little more money make you a little happier? you may say, YES!

– – – – – – –

This week we continue our winter series :

GROW-ing…

We’ve been talking about and will continue to talk about Spiritual Formation, Generosity, Impact and Community.

– – – – – – –

Today we continue with GENEROSITY, but will move into some practical thoughts on giving and stewardship.

Today we continue with GENEROSITY, but will move into some practical thoughts on giving and stewardship.

Last week we walked through 2 Corinthians 9, which deals some important things about generosity:

- It’s about investing, not losing.

- It’s about a decision, not the dollar

- Everyone wins with generosity

- God’s mission is resourced through generosity

2 quotes we want you to remember:

“The kingdom that Jesus preached & lived was all about a glorious, uproarious, absurd generosity”

“It’s the decision, not the dollar, creates a giver!”

We said that this week we’d get into the nitty gritty of it. Well here we go.

Why even talk about this? Why talk about money?

(and please know that we don’t talk about money too often around The Village)

Generosity is a theme through out scripture. You can’t miss it. If you do, you’re reading with blinders on. Money, gifts, possessions, time – it’s all there. God gives – God calls us to give. God loves – God compels us to love.

The bible talks about money a lot. Directly 800 times, indirectly, more than 2000 times. That’s a lot.

More than 1/3 of Jesus’ parables include references on money or possessions.

Why do you think that is?

Because what we own, make, spend, keep, and owe, is connected to a deeper place – our heart.

Jesus says (Matthew 6) You can’t serve both God & Money.

- Mammon, the word for money in this text, refers to property and wealth as a god…as an idol. It was a Chaldeon word for both god & money.

- Jesus’ point is clear: don’t turn money into what it was never supposed to be, a god, an idol.

- We joke about the term, “almighty dollar”, but we are well aware of it’s power.

Jesus is warning us to be careful not to let money give you orders or boss you around.

You’ve probably heard this… “Money makes a wonderful servant, but a horrible master”

Who has ever felt like a slave to money? Either by choice or by circumstance?

– – – – – – –

This is why stewardship is so important – using wisely, what’s been given to you. Using what you have – your time, gifts, skills, land, opportunity, and MONEY, well.

The reason we even use the word ‘steward’ is because we have come to the understanding that everything we have comes from God, and in light of that, we ‘steward’ the gifts of money, time, and opportunity, that we have been given to us.

Psalm 24:1 is the bases for this, “The Earth is the Lord’s and everything in it, the world, and all who live in it.”

As people who are discovering what it means to follow Jesus, this is the worldview we start from. This is the lens by which we see the world.

If this is true…that what we have has been given to us, then we are responsible to ‘steward’ it well.

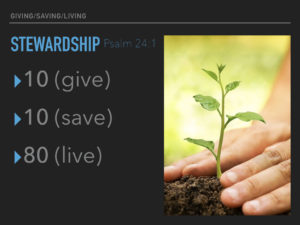

Here’s the best way I know how to steward finances: 80-10-10. This works! Many Studies, Psychologists, Financial planners, all agree that this works. People without faith in Jesus have even come to know that this works. Live on 80%, Save 10%, Give away 10%. It’s good math. It’s good human ethics.

But…if we believe what Psalm 24 says, then we must turn these numbers around:

10 – 10 – 80

Give Save Live

I GIVE…so that it’s not all about me

By giving first, I invite God back into the equation.

By giving first, I remove the chance for selfishness to creep in.

By giving first, I’m grateful for what God gives me.

By giving first, I’m living with open hands instead of tight fists.

So you’ve figured that part out. Which means you’ll probably ask this next question, How much do I give?

- YES, 10% is either a great place to start or a great place to strive for.

- There are some really good biblical principals that encourage this (Mal 3, Lev 27, Num 18, etc)

- It works – it’s good – but it is an OT law. Do you follow every other OT law? Hmmm.

- Paul says, decide in your heart what you will give. (2 Cor 9)

- Think about it. Pray about it.

- Be strategic and thoughtful about it.

- Which means your giving might be even end up being more, depending how God is challenging and directing you.

Here’s the thing, I really think that giving 10% to the local church is an act of trust, of worship, of gratefulness, of community. And I also believe that if you do this, you will continue to experience God’s provision, and will continue to see all you have as God’s gift to you.

BUT…if you’ve never done this; if you’ve never given 10% of your income away (at the beginning of your budget), I want to encourage you to start somewhere, and see what God does, in and through you. If you’re at 0%, start at 3%. If you’re at 2%, try 5%. If you’re used to giving, but aren’t so consistent with it, commit to 10% at the top. It’s amazing what God will do.

Andy Stanley offers a two-fold approach: form a basic plan with a willingness to consider spontaneity when opportunities arises!

I SAVE…so that it’s not all about now

Canadians save less today than 10 years ago. 0.8%, down from 1.4% (this will eventually effect consumer spending and economic growth).

People spend almost $5000 a year in impulse purchases – that’s almost a full TFSA limit.

Seth Godin Talks about the $37000 latte.

- $4 a day on an afternoon coffee or snack

- 10+ years of this + the credit card high percentage debt = $24000

- saving that same money with 7% over 10 years = $13000

I’m not telling you not to buy coffee, but if you’re buying coffee and not saving, something’s wrong.

If you’re buying stuff before you save, that’s not right.

If you’re wasting money without knowing where it’s going, and not saving for your future, it’s simply unwise.

Proverb 6:6-8 says,

Take a lesson from the ants, you lazybones.

Learn from their ways and become wise!

Though they have no prince

or governor or ruler to make them work,

they labor hard all summer,

gathering food for the winter.

There are lots of ways to save. Just like giving, you have to be strategic and decisive about it.

I LIVE…on the rest, as a mature & responsible neighbour, friend, parent, and human.

Proverbs 13:7

One pretends to be rich, but has nothing.

One pretends to be poor, but has great wealth.

Proverbs 22:6 has been quoted at baby dedications, “Start children off on the way they should go, and even when they are old they will not turn from it.”

Funny thing is that the verses that follow are about stewardship & generosity.

(7)The rich rule over the poor,

and the borrower is slave to the lender.

(9)The generous will themselves be blessed,

for they share their food with the poor.

(16)One who oppresses the poor to increase his wealth

and one who gives gifts to the rich—both come to poverty.

Stewarding God’s resources takes planning & training. It’s takes some work.

Why not try talking about the 90%? We (rightfully and sincerely) encourage conversation about the 10% of giving off the top. However, if we’d be wise and intentional about the rest, the 90%, we’d have no problem giving away the 10%.

Many are unable to be generous because they have yet to develop a sustainable plan for what we decide to keep.

Simply put: Live below your means. You have 3 choices: above, within, below. Which one do you think is best?

TAKE IT HOME

Giving takes TRUST

Saving takes SMARTS

Living on less takes GUTS

All 3 of these…honour God.

– – – – – – –

Bonus Material: (sign up for our Sunday Financial Health Classes)

On Giving…

– Make a budget and when doing so, put giving at the top, before any other expense.

– Start with something. If 10% sounds crazy, start with something smaller for now.

– Pray about this. Ask God what he thinks you should give. We ask God for all sorts of stuff. We ask God for wisdom in all areas of our life. He is faithful to lead and direct you in the process with gentleness.

– Create a rhythm and routine. Give weekly or monthly or every time you get paid. Make it a first thing, not a last thing. Use our Canada Helps partner to make it easier. Or use an envelop system if you like to give cash or cheque. This helps you to be committed to what you’ve decided to give.

– Be open to God’s voice in your life. Be open to opportunities to help, to serve, to give. In the end, as much as your giving is helping (the local church, a charity, a neighbourhood need, etc) others, your giving is actually helping you to become the person God is shaping you to be.

On Saving…

– Those who don’t save are saying that they don’t care about their future.

– Those who don’t save are thinking selfishly about today, without any thought for tomorrow.

– Yes, there are seasons where saving might feel impossible or is impossible, but don’t let that be the norm.

– Save for: 1 – emergencies, 2 – retirement, 3 – future purchases, (4 – education if you have kids)

– When you get a deal on something, save the difference.

– When you finish paying something off (car, furniture, loan), keep saving some or all of that money.

– If you’re buying $5 coffees, but aren’t saving, that is not good. Buy cheaper coffee and save the difference. That goes for any small luxury.

– It’s not that you shouldn’t enjoy going out or vacationing or nice things. Please do. But, if you’re spending money on those things and not saving, then you’re doing it wrong. Save first, use what you have left to spend & enjoy.

On Living…

– All we will say here is this: create a budget, and stick to it. It’s amazing what we can live on when we create healthy parameters to live within.